NY Times 4/7/24: Insurers Reap Hidden Fees by Slashing Payments. You May Get the Bill.

This lengthy article details “a little-known data analytics firm called MultiPlan. It works with UnitedHealthcare, Cigna, Aetna and other big insurers to decide how much so-called out-of-network medical providers should be paid. It promises to help contain medical costs using fair and independent analysis.”

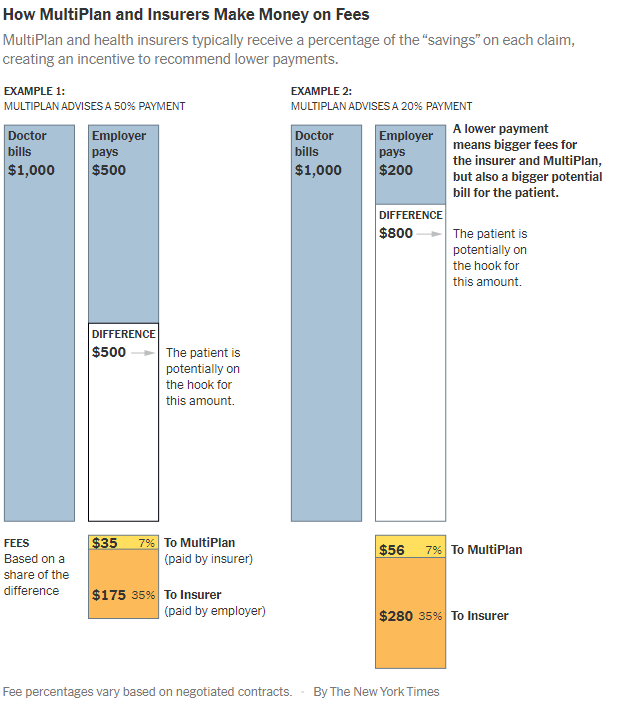

“But a New York Times investigation, based on interviews and confidential documents, shows that MultiPlan and the insurance companies have a large and mostly hidden financial incentive to cut those reimbursements as much as possible, even if it means saddling patients with large bills. The formula for MultiPlan and the insurance companies is simple: The smaller the reimbursement, the larger their fee.”

The backdrop on MultiPlan was a scandal 15 years ago. The NY Attorney General concluded that the insurance companies had “a payment system riddled with conflicts of interest had been shortchanging patients, and at its core was a data company called Ingenix. Insurers used the company, a UnitedHealth subsidiary, to unfairly lower their payments and shift costs to patients, the probe found…UnitedHealthcare, Cigna, Aetna and other major insurers agreed to replace Ingenix with a nonprofit that would provide independent pricing data…The companies were required to use the nonprofit database for only five years.” Subsequently, the insurance companies turned to Multiplan. In a 2015 email, a Cigna risk officer:: “We cannot develop these charges internally (think of when Ingenix was sued for creating out-of-network reimbursements). We need someone (external to Cigna) to develop acceptable” rates, she wrote.

Some of the examples of out-of-network charges in the article included:

- Gail Larson had surgery on a non-healing chest wound. “UnitedHealthcare, advising that Dr. Rabinowitz would be paid $5,449.27 — a small fraction of what he had billed the insurance company. That left Ms. Lawson with a bill of more than $100,000.”

- “Kelsey Toney, who provides behavioral therapy for children with autism, who was receiving a payment of half the medicaid rate for providing care.”

- “Cari Campbell, who received fertility treatment in Minnesota, was charged thousands of dollars.”

- “Justin Dynlacht, who has Crohn’s disease, paid extra for a plan that covered such visits. After seeing two in-network doctors about persistent abdominal pain, he went to an outside specialist who discovered a hernia containing abdominal tissue. Aetna sent the specialist’s claims to MultiPlan, and Mr. Dynlacht was left with thousands of dollars in bills.”

My take: Insurance companies in coordination with Multiplan rip off their policy holders by not providing reasonable coverage for their out-of-network medical care. Ultimately, patients will be increasingly affected as many physicians/hospitals walk away from insurers who are offering low reimbursement rates to in-network providers too. Insurance companies are incentivized to not care.

Related blog posts:

- How Insurance Companies Save Millions in Denying Care

- NY Times: ‘What’s My Life Worth?’ The Big Business of Denying Medical Care

- Expert Actuary is Overcharged by the Hospital in ‘Collusion’ with the Insurance Company– Guess Who Wins

- “We Need More Information to Process This Claim”

- No One Would Design U.S. Healthcare System This Way

- “Health Insurance Is Broken”

- Healthcare: “Where the Frauds Are Legal”

Not sure how to send requests to you – but would you cover the new FTC ruling

See tomorrow’s post