- Matt Stoller, BIG, Substack newsletter: The Real Reason Walgreens Collapsed

This newsletter explains why Walgreens is collapsing. My concern is that even a company as big as Walgreens had hardly any control over the declining reimbursements for their pharmaceutical sales. They had to accept the reimbursement due to a lack of leverage related to the consolidation of insurance companies and pharmacy benefit managers (PBMs). Without intervention to reverse the ongoing consolidation of these companies (as well as hospitals), patients will face fewer choices and higher costs. Physician groups will face existential business threats.

Here’s an excerpt from the newsletter:

Walgreens is America’s second-largest drug store chain, and has been a public company for more than 100 years… it has closed a thousand stores since 2018, and plans to shut 1,200 more this year…

The real reason Walgreens, and the pharmacy business in general, is dying, is because of a failure to enforce antitrust laws against unfair business methods and illegal mergers…Moreover, even today, the other financial numbers from Walgreens aren’t bad. Sales aren’t going gangbusters, but the number is basically increasing, and so are the number of 30-day prescriptions, even though they’ve cut the number of stores every year since 2017…

But in its main line of business – pharmaceuticals – Walgreens doesn’t set prices. Insurance companies do. And there’s the rub…Walgreens gets a set reimbursement from that consumer’s insurance company for that medication. How much does it get? Well, those insurance company’s contract with what’s called pharmacy benefit managers (PBMs) to manage negotiations with pharmacies…

Theoretically, both sides have some leverage in this negotiation. If a pharmacy chooses not to accept the prices and terms offered by those PBMs, then consumers who have an insurance company that uses that PBM just won’t go there…Pricing wasn’t a big problem for Walgreens when there were lots of PBMs, because it had the ability to say no if the deal was unreasonable, and still maintain a flow of customers…Today, there are really only three PBMs – Express Scripts, Caremark and OptumRx – serving 80% of customers…

In 2015, the big three, with their market power, began lowering reimbursement rates on pharmacies and charging a host of new fees…

PBMs, however, are engaged in a sort of industry-specific arson. And we can see this dynamic by looking at independent pharmacies writ large, nearly one in three of whom have closed in the last ten years. Today, 46% of U.S. counties now have pharmacy deserts, meaning no pharmacies at all…

326 pharmacies have closed since December of 2024. Why is that month significant? Well, that’s the month Elon Musk tanked legislation to address some of the monopolistic squeezing that PBMs are putting on pharmacies and consumers.

Related explanation of PBMs (Dr.Glaucomflecken): The Middlemen of Healthcare (includes useful organizational flowchart)

Related blog posts:

- “Commercial Insurance Isn’t in the Health Care Business. It’s in the Financial Business.”

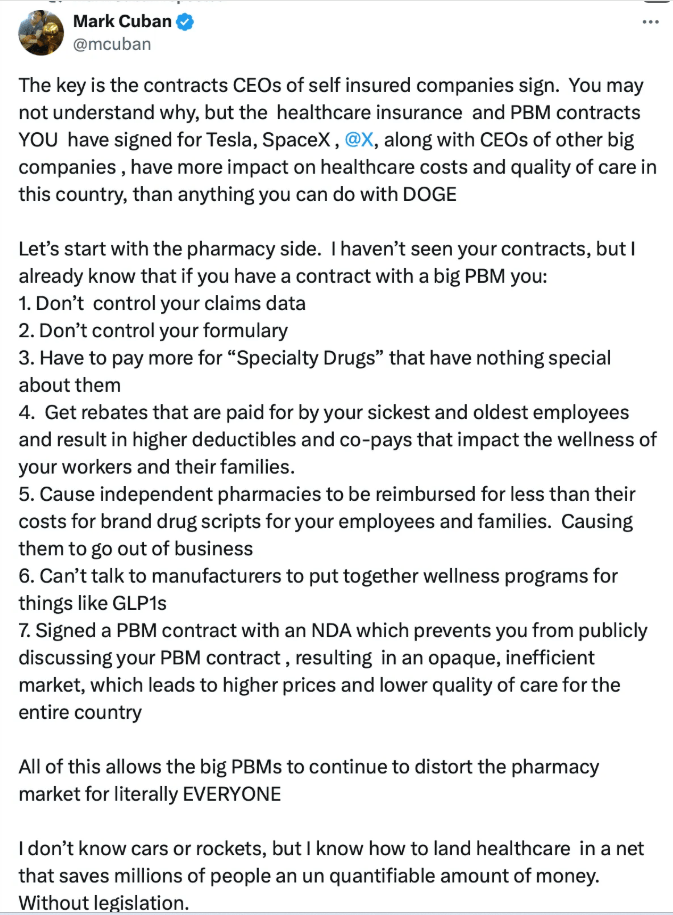

- Mark Cuban: Disrupting American Healthcare

- Consolidation and Competition in Health Care

- Medical Billing Trap: Hospital Pricing for Urgent Care Visits and Outpatient Departments

- The Failing U.S. Health System

- What Is Driving Hospitals’ Acqui$ition of Physician Practices?

- Delays by Insurance Companies Result in Worse Outcomes for Children with Inflammatory Bowel Disease

- Changing Business of Medicine: Hospital Consolidation of Physician Practices

- “Denials, Dilly-dallying and Despair”

- Another Health Insurance Predatory Practice and One Doctor’s Quest to Stop It

- How Insurance Companies Betray Their Policy Holders in Dealing with Out-of-Network Physicians

- Healthcare: “Where the Frauds Are Legal”

- No One Would Design U.S. Healthcare System This Way

- NY Times: America can afford a world-class health system. Why don’t we have one?

- We are Last in Health Care Among High Income Countries