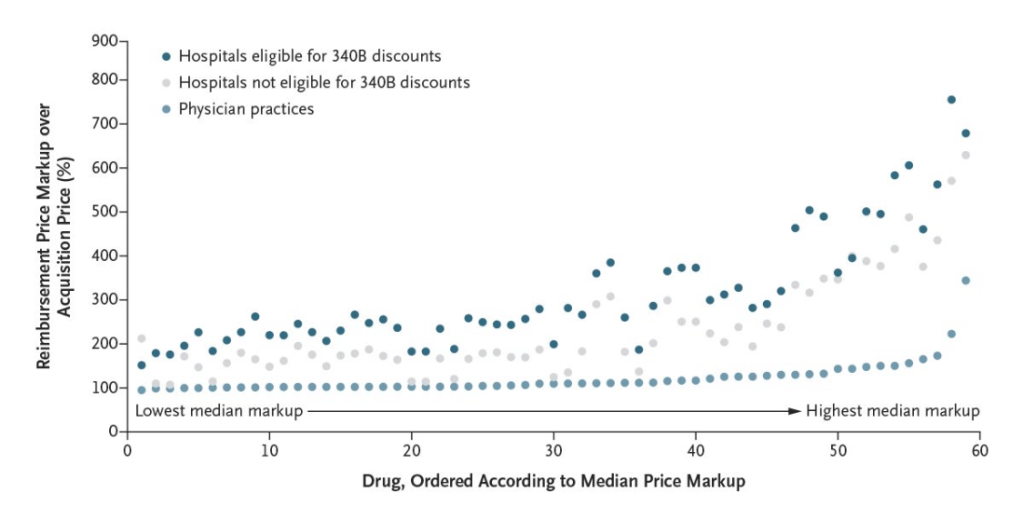

JC Robinson et al. NEJM 2024; 390: 338-345. Hospital Prices for Physician-Administered Drugs for Patients with Private Insurance

In this study, the authors used 2020–2021 national Blue Cross Blue Shield claims data regarding patients in the United States who had drug-infusion visits. This included 404,443 patients in the United States who had 4,727,189 drug-infusion visits. The authors examined 57 medications which represent the most expensive physician-administered drugs.

Background:

“Approximately one third of hospitals, including all specialized cancer hospitals, are also eligible for large discounts off drug acquisition prices under the federal 340B Drug Pricing Program.Hospitals thus have two means to generate profits from physician-administered drugs. Hospitals can reduce what they pay to manufacturers for the drugs, especially if they are eligible for 340B discounts, and can increase what they are paid for the drugs by imposing markups on the reimbursement prices they charge to insurers.”

Key findings:

- The median price markup (defined as the ratio of the reimbursement price to the acquisition price) for hospitals eligible for 340B discounts was 3.08

- After adjustment for drug, patient, and geographic factors, price markups at hospitals eligible for 340B discounts were 6.59 times as high as those in independent physician practices; price markups at noneligible hospitals were 4.34 times as high as those in independent physician practices

- Hospitals eligible for 340B discounts retained 64.3% of insurer drug expenditures, whereas hospitals not eligible for 340B discounts retained 44.8% and independent physician practices retained 19.1%.

- When we look at high drug costs, much is due to price markups NOT due to the manufacturers (which is already a lot). In this study, hospitals eligible for 340B discounts “retained almost two thirds of insurer drug expenditures, passing on only one third to the drug companies.”

My take: In my view, the health care market is messed up.

- Hospitals charge exorbitant amounts for infusions (and other care) and this is worsening with consolidation

- Insurance companies are difficult to work with and often deny needed care. Patients and physicians have little leverage to get them to fulfill their obligations.

- Pharmaceutical companies use a myriad of tricks to increase the costs of their medications (see blog posts below) and charge U.S. consumers much more than what patients pay in other countries

- Physicians are not incentivized to limit costs for patients/insurers. Many worry their reputations will suffer and they will be exposed to legal liability if thorough evaluations are not performed.

Related issue:

Related blog posts:

- No One Would Design U.S. Healthcare System This Way

- “Health Insurance Is Broken”

- Healthcare: “Where the Frauds Are Legal”

- Another Health Insurance Predatory Practice and One Doctor’s Quest to Stop It

- FDA ‘Safety Initiative’ Now Means an Ounce of Ethanol Costs $30,000

- High Rates of Denying Medical Care for Medicaid Patients Managed by Health Insurers

- Consolidation and Competition in Health Care

- Poster Child for Gaming Pharmaceutical Regulations: Humira

- Insulin: “Poster Child For Everything That’s Wrong” with U.S Drug Costs

- Heroes, Villains and ‘Perverse’ Incentives. Story of Big Hospitals vs. Big Pharma

- Why U.S. Consumers Pay More For Medications

- 5000% Increase for Well-Established Drug | gutsandgrowth

- Cornering the Generic Markup | gutsandgrowth

- For Policy Wonks: Bayh-Dole Act and Reducing Pharmaceutical Costs

- Another Shady Pharmaceutical Business Practice: Citizen’s Pathway to Delay Competition

- Turning Liquid into Gold: A Pharmaceutical Rumpelstiltskin Story

- U.S. Health System: ‘World Leader in Amputations’

- Out of Pocket Maximum (Sad Humor)

- Choosing Health Insurance -Humor