Ron Lieber, NY Times 9/14/25: A Message From Your Doctor About the Prior Authorization Process

This article recommends that physicians consider a proactive role in explaining the prior authorization process. Here is his suggested handout:

We want to make sure you understand something called “prior authorization.”

Often, insurance companies require us to ask their permission for coverage before prescribing a drug or doing a test or procedure. They say they do this to make sure that we are suggesting medically appropriate, cost-effective care — on behalf of you or your employer. In fact, this is always our goal, but they don’t always think we’re accomplishing it.

To try to get this authorization ahead of time, we document our logic in the format they require, and they may reject it. Often we find out about rejections well before any surgery, but sometimes we don’t.

The doctors here often don’t understand why insurers reject our requests for permission.

The prior authorization process can be as baffling to us as it may be to you, and we find it intensely frustrating. Please keep in mind that we are at the mercy of dozens of insurance companies, and their rules and requirements can change constantly. Your doctor may not be able to predict the odds of a prior authorization rejection, and musing over the possibility before it happens probably isn’t a productive use of our time together in the exam room.

We do have billing specialists who handle prior authorization requests for our doctors.

If you have any concerns once you know what we’re recommending, reach out to our billing specialist or the department that helps with this. They too may not be able to tell you much ahead of time, but they will play a role in helping us with any appeal that is necessary if our request for prior authorization fails in full or in part.

Watch for all communications — from us but especially from your insurance company.

Insurance companies like paper mail. Check yours every day, in case they issue denials that way. Download your insurance company’s app and sign up for push notifications for any changes, especially if they offer alerts specifically for changes in prior authorization. Opt in to email notifications, and check your spam.

You might hear from the insurance company before we do.

We are partners here, and you have a role.

We think we are pretty good at navigating this deeply suboptimal system, but we can’t do it without you. Please, become intimately familiar with your insurance plan and what it covers — whether prior authorization is required or not.

Engage a human resources specialist at your employer, if you have one, to help communicate with the insurance company during the prior authorization process if you think you might need help. Call the insurer on your own to ask whether your medicine or procedures require permission and whether the insurance company is missing information it needs.

Patients can sometimes get better information faster than we can, if only because we may be trying to help hundreds of patients at once.

What happens if our prior authorization request is rejected?

There is an appeal process, which may differ by insurer. Contact a billing specialist with whatever information you have from your insurance company, though we may hear about it before you do and start the process on our own.

Sometimes, the problem is a relatively simple one, resulting from confusion over the byzantine process of submitting medical codes, or some similar snafu. But often, a doctor will have to do what’s known as a peer review with someone from the insurance company. We find this burdensome, since the “peer” on the line with us may not have the same level of expertise as we do. That prolongs the call, adds to our overall operating expenses and keeps us from spending more time with you, the patient.

We’ll give any appeal our best shot, but it may take time to schedule any peer review.

Please don’t worry.

We dislike having to give you a document like this that might produce anxiety. Still, it’s better that you be aware of how things might go than be desperately trying to reach us or learn about the prior authorization process after getting a mysterious and indecipherable rejection letter in the mail.

If things don’t go our way at first, we will have your back and argue fiercely to get you coverage for the care you need.

Still, there is only so much we can do to make this easier.

Our industry has a structural problem. We can provide you information and over-communicate, but the incentive systems are what they are.

Insurance companies may sometimes deny permission for care in order to make more money. Employers (and individuals) don’t want premiums to rise. Some patients demand that we throw everything we doctors have at every health condition. Regulators are in the middle of all of it, ordering up paperwork. And doctors are not infallible.

We wish we could fix all of that. But for now, we can be plain-spoken with you about how prior authorization works and try to make the system that we have just a bit more tolerable.

Related posts:

- AI Skirmish in Prior Authorizations

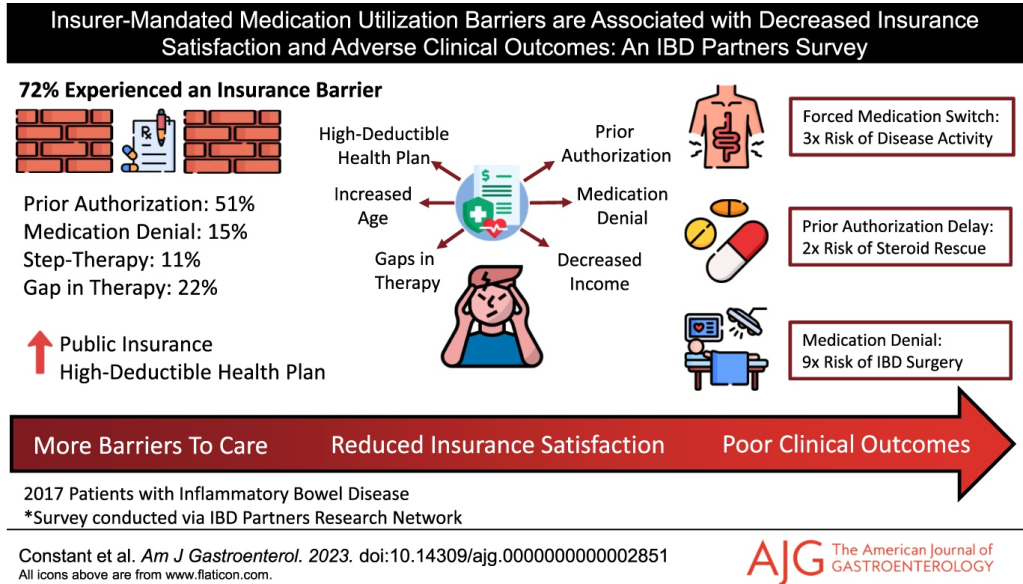

- The Consequences of Prior Authorizations

- Rising Prescription Drug Denials by Health Insurers

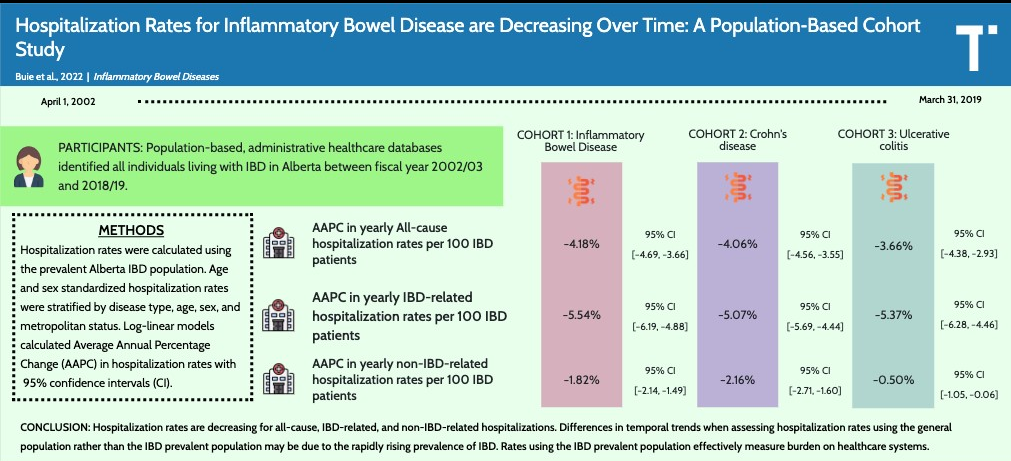

- Delays by Insurance Companies Result in Worse Outcomes for Children with Inflammatory Bowel Disease

- NY Times: ‘What’s My Life Worth?’ The Big Business of Denying Medical Care

- “Denials, Dilly-dallying and Despair”